Share with

Credit monitoring and preventive intervention with real-time Early Warning Systems

The large-scale disruption brought on by the new normal calls for financial institutions to exercise more caution when it comes to managing their lending activities. Technology-aided solutions, like the real-time Early Warning System developed by BCT Digital, are changing the game – by detecting systemic flaws and vulnerabilities, and upholding the sanctity of the credit management process. On a macro scale, these systems will be instrumental for FIs to build the systemic stability and competitive advantage needed to thrive in the new normal.

Credit monitoring is an integral part of the lending activity of financial institutions. These organizations have a great responsibility for not only extending timely credit but also maintaining asset quality through continuous monitoring and recovering dues in time. Traditionally, adequate precautions are taken during the assessment and sanction of a loan, however, a lender has to be much more vigilant during the lifetime of the loan and ensure its full recovery.

To achieve this, proactive credit portfolio monitoring must be in place rather than just a reactive approach. Early Warning Systems are technology-led solutions that enable proactive credit monitoring by generating early warning signals of incipient stress or credit fraud events. Warning signals on critical credit events need to be generated at the earliest possible occasion, and timely corrective/preventive measures should be taken before irreversible damages are sustained by the bank on account of any slippage in credit exposure.

Technology has enabled customers to operate their loan accounts with the click of a button from anywhere in the globe, enabling funds to be moved out of the account without much effort. In this scenario, what is needed is not just a detective system that unearths problems after they have occurred (such as by reporting that bank funds availed by a company have been transferred to overseas companies), but rather a preventive EWS system that forewarns bankers of suspicious transactions and enables them to stop such transactions in real-time before they are completed.

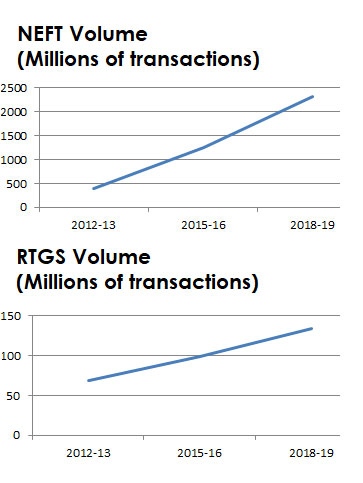

The above shift towards electronic payment systems has brought with it challenges as well as opportunities:

- On one hand, the velocity of transactions has increased, thereby making funds siphoning easier and traceability of funds by bankers and authorities all the more difficult.

- However, on the other hand, digital transactions leave a record, which can be drilled down to minute detail with the technology available today, on a real-time basis.

A real-time EWS typically involves the following:

- Integration with source systems in a real-time mode: In a bank, there are various financial and non-financial transactional systems; core banking system, SWIFT messaging, and RTGS/NEFT systems are prominent amongst them. For real-time EWS, seamless integration with the source systems is a pre-requisite. This facilitates all transactional details to flow from the source systems to the EWS system.

- Processing of all transactions in real-time: A real-time EWS system is capable of scanning all inward and outward transactions on a real-time basis, from the point of transaction initiation by the customer to the stage of completion (acceptance/rejection of the transaction).

- Scrutiny of each transaction based on pre-set rules in the EWS rule engine: All transactions are subjected to a filtering process using rules appropriately selected from a library of pre-set rules configured to detect fraudulent and suspicious transactions, much before they are posted into the CBS.

- Reverse feedback to source systems: Once processing is done by the real-time EWS, along with an alert within the EWS system for records and future tracking purposes, feedback is sent back to the source system which originated the transaction. Illustrative feedback could be in the form of:

- Allowing the transaction to pass through without any warning, if all transaction parameters are fully compliant with the applied criteria and rules

- Allowing the transaction to pass through, but with a warning, in case something suspicious is detected

- Provision for manual intervention by the bank staff for applying their expert judgment.

- RTGS/NEFT/IMPS transactions

- Cheque clearing – inward, outward

- SWIFT/SFMS messages

- Intra bank transfer

Conclusion

While traditional Early Warning Systems ensure banks are alerted of signs of stress in borrower accounts months before they turn defaulters, fraudsters operate at a much faster speed – with round the clock internet-enabled transactions and a greater amount of global trade across countries. Hence a real-time EWS that can prevent suspicious transactions instead of merely reporting them is the need of the hour.Authors

Author

Kasthuri Rangan Bhaskar

VP, Financial Services Practice & Risk SME (Lead) at BCT DigitalMr. Kasthuri is the Risk SME (Lead) at Bahwan CyberTek with profound experience in Market Risk & Credit Risk, and has over 15 years of experience in the BFSI sector. He has experience working with some of the large mainstream BFSI labels in the country.

Author

Shankar Ravichandran

Senior Manager at BCT DigitalHis profound expertise in the field of corporate and retail banking spanning across Credit Risk, Transaction Banking, Service Delivery and Product Management is close to decade. He is an MBA graduate from Indian Institute of Management, Bangalore.

Author

Ashish Jajodia

CFA Senior Consultant, Risk management at BCT DigitalWith 12+ years of experience across multiple industries, he has profound expertise in the field of Risk Analytics, Predictive Analytics, Credit Appraisal, Hedging, Project Financing, Financial Planning and Business Development Strategy. He holds a CFA Charter and is an MBA graduate.